salt tax deduction limit

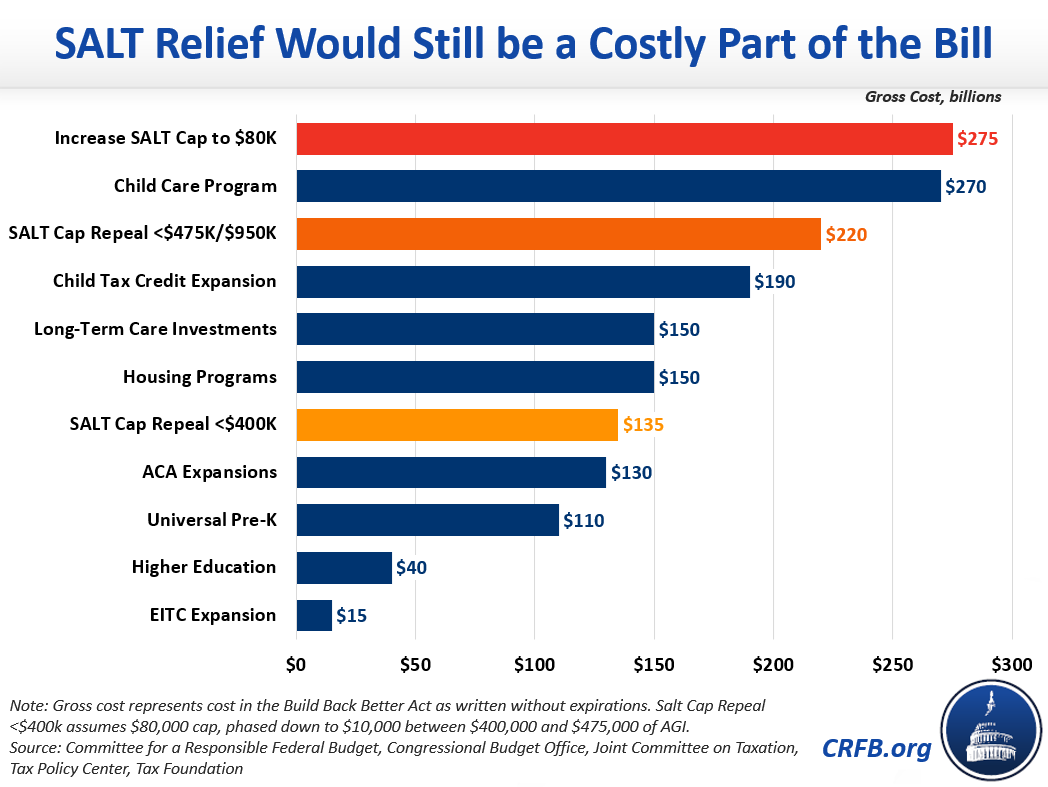

The 10000 limit on SALT deductions has a significant measurable revenue impact affecting the federal budget. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

States Help Business Owners Save Big On Federal Taxes With Salt Cap Workarounds Wsj

Free shipping on qualified orders.

. Spouses and the State and Local Tax Deduction Spouses Filing Separately For spouses that file separate tax returns the SALT deduction is limited to 5000 per person. Under the SALT Act people making less than 400000 would once again be permitted to deduct all state and local taxes on their federal income tax returns provided they itemize their deductions. State and local tax SALT deduction.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. 52 rows The SALT deduction allows you to deduct your payments for property. Definition This deduction is a below-the-line tax deduction only available to taxpayers who itemize Its only available to taxpayers who have eligible state and local taxes to deduct.

As we talked about above the SALT deduction limit for 2020 is capped at 10000. Prior to the limits enactment the cost in lost revenue for the federal government. Because of the limit however the taxpayers SALT deduction is only 10000.

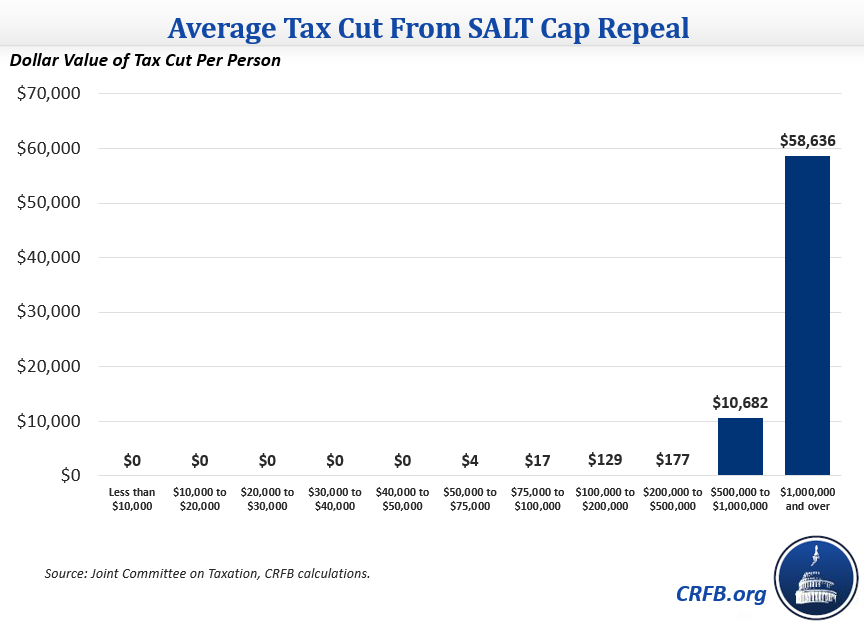

Starting with the 2018 tax year the deduction was limited to 10000 for state and local income taxes paid. The SALT deduction tends to benefit states with many higher-earners and higher state taxes. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

The History of the SALT Deduction The SALT deduction has been a part of our federal income tax since 1913. Senate Budget Committee chair Bernie Sanders will include a partial repeal of the Tax Cut and Jobs Acts 10000 cap on the state and local tax SALT deduction in his proposed budget resolution. Previously the deduction was unlimited.

No limit existed before the Trump tax cuts. Enacted by the Tax. Free easy returns on millions of items.

The limit however is scheduled to expire on December 31 2025 when most of the individual tax changes in the TCJA are set to expire. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. Filing status differences in SALT deduction.

New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property. The filing status of the taxpayers also matters. Ad Browse discover thousands of unique brands.

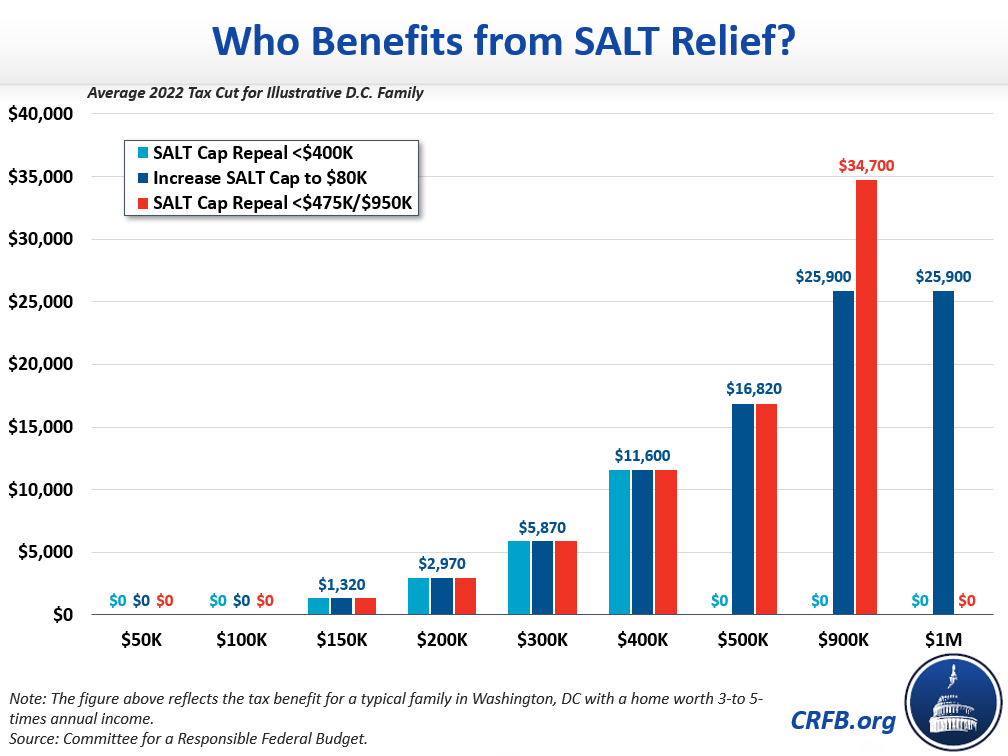

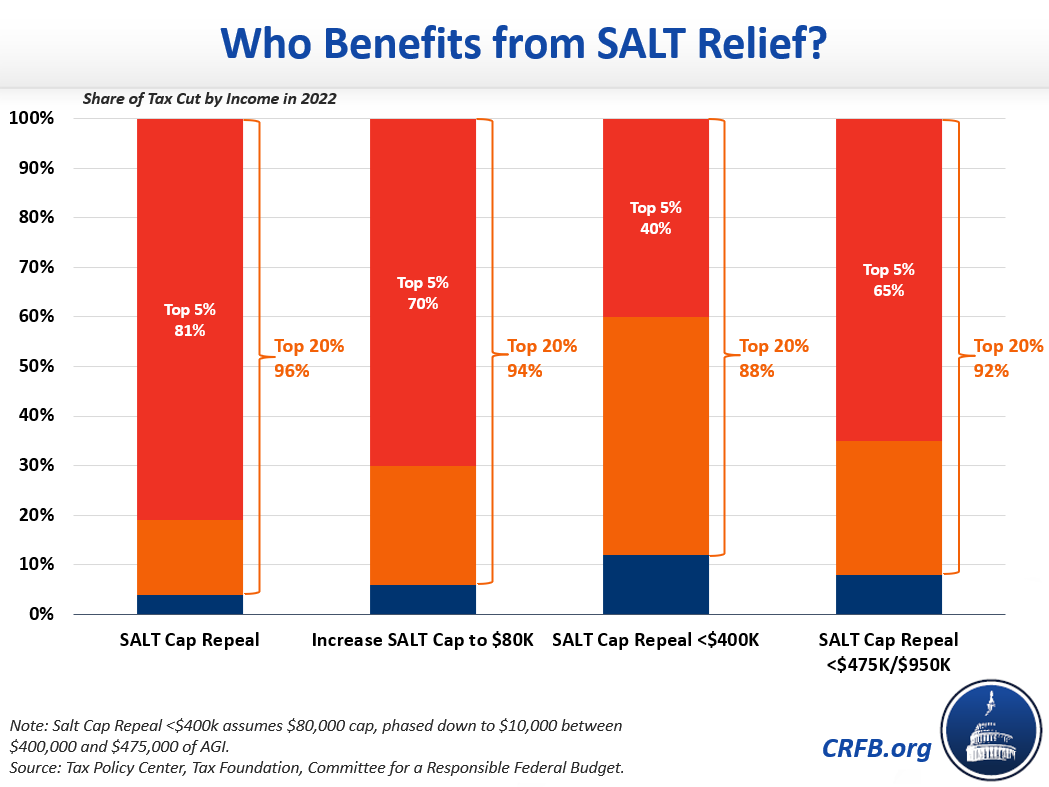

Learn More At AARP. He has not described details but says the cap likely would remain for high-income households. Democrats consider SALT relief for state and local tax deductions One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about 400000.

The expansion of the standard deduction further limited the value of the SALT deduction for taxpayers under the 10000 cap. We will update this page if it is made official. There is talk that the SALT deduction limit will be increased from 10000 to 70000 as part of the Build Back Better Plan - this bill has not been signed into law.

SALT deduction limit background The Tax Cuts and Jobs Act of 2017 placed a 10000 cap on State and Local Tax SALT deductions. Beginning in 2017 SALT deductions were limited to. Community Property Considerations If you live in a state that recognizes community property ownership determine which spouse has legal ownership of the property in question.

This was true prior to the SALT deduction cap and remained the case in 2018. Trumps tax law limited SALT deductions to 10000 meaning that residents in higher-tax states like New York and New Jersey could no longer deduct the full value of their state tax obligation from their federal bill. Starting with the 2018 tax year the maximum SALT deduction became 10000.

There was previously no limit. Its currently limited to 10000. Read customer reviews best sellers.

Sanders would partially repeal the SALT cap. 54 rows In 2018 only 321 percent of those filers itemized. To be impacted by the limit 3 things must be true.

The SALT Deduction Post-Reform The TCJA limited the SALT deduction available to individual taxpayers. SALT Deduction Limit 2022 BBB Act New limits for SALT tax write off. The Tax Cuts and Jobs Act TCJA capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. 1 day agoThe New Jersey Democrat has been among the lead advocates in Congress for lifting a 10000 limit on the deduction which Republicans imposed as part of their 2017 tax overhaul.

In tax years 2018 to 2025 the SALT deduction is capped at 10000 for single taxpayers 10000 for married couples filing jointly and 5000 for. The limit is also important to know because the 2021 standard deduction is 12550 for single filers and 12950 in 2022. 100s of Top Rated Local Professionals Waiting to Help You Today.

You pay more than 10000 in State and Local Taxes or you havent reached the limit obviously State income tax Property taxes. The spending and tax package now pending in the Senate is likely one of the few opportunities to make that change. The unlimited SALT deduction allowed millions of Americans to use state and local tax bills to reduce federal taxes on a dollar-for-dollar basis.

This will leave some high-income filers with a higher tax bill.

This Bill Could Give You A 60 000 Tax Deduction

Shaking Up Your Salt Deductions Jmf

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

Virginia Salt Cap Workaround Hantzmon Wiebel Cpa And Advisory Services

New Limits On State And Local Tax Deductions Williams Keepers Llc

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

Third And State A Progressive Take On Public Policy In Pennsylvania

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

This Bill Could Give You A 60 000 Tax Deduction

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Menendez Criticizes Salt Cap Proposal Under Consideration For Spending Bill The Hill

Ny State Pass Through Entity Tax A S A L T Cap Workaround Fuoco Group

Salt Repeal Just Below 1 Million Is Still Costly And Regressive Committee For A Responsible Federal Budget

Democrats Vow Repeal Of Salt Cap Bond Buyer

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep